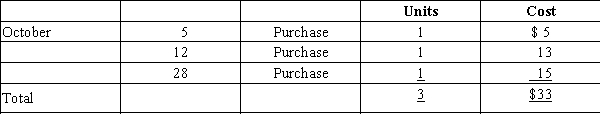

Assume that three identical units of merchandise are purchased during October, as follows:  Assume one unit is sold on October 31 for $28. Determine cost of goods sold, gross profit, and ending inventory under the FIFO method.

Assume one unit is sold on October 31 for $28. Determine cost of goods sold, gross profit, and ending inventory under the FIFO method.

Definitions:

Joint Processing Costs

Costs that are incurred up to the split-off point in a process that produces multiple products from a common input.

Financial Advantage

The benefit attained from making certain business decisions or investments, often measured in terms of improved profitability or cost savings.

Processed Beyond

A term used to describe a stage in production or manufacturing where goods have progressed past a certain point in the production process.

Absorption Costing

An accounting method that includes all direct and indirect manufacturing costs in the cost of a product, including overhead.

Q11: For each of the following notes receivable

Q34: Rodgers Company gathered the following reconciling information

Q57: last document in the chain, use to

Q74: During the closing process, some balance sheet

Q79: Accrued taxes payable are generally reported on

Q101: Cumberland Co. sells $2,000 of inventory to

Q114: When the terms of sale are FOB

Q153: Which of the following is not an

Q170: Direct disposal costs do not include special

Q198: Account where returned merchandise or price adjustments