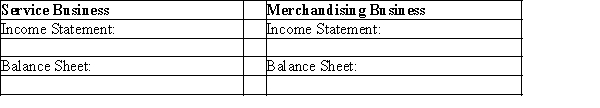

Describe the major differences in preparing the financial statements for a service business and a merchandising business.

Definitions:

Appropriate Discount Rate

The rate used to discount future cash flows to their present value to account for risk and time value of money, reflecting the opportunity cost of capital.

Interest Rate

The share of a loan incurred as interest costs to the borrower, habitually depicted as an annual percentage of the loan's outstanding amount.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating the proportion of any additional dollar of income that must be paid in taxes.

Weighted Average Cost

A calculation that takes into account the varying costs of goods or services by weighting them according to their importance or quantity.

Q13: The current ratio for the past three

Q20: In a merchandising business, sales minus operating

Q68: During periods of rapidly rising costs, the

Q116: Astin Company has current assets of $82,530,

Q124: President's salaries, depreciation of office furniture, and

Q131: Colma Company purchased merchandise on account from

Q143: Inventory system that updates the inventory account

Q175: Buster Industries pays weekly salaries of $30,000

Q183: Which of the following is not a

Q231: Use the information in the table to