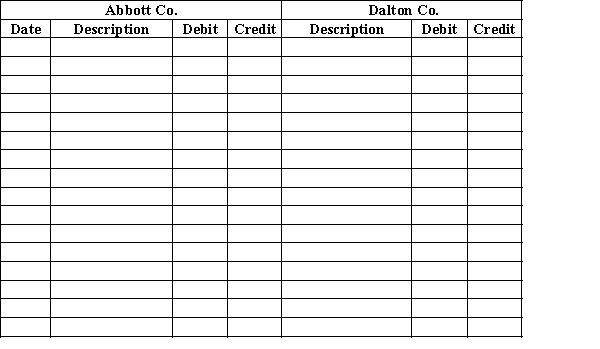

Journalize the following transactions for both Abbott Co. (seller) and Dalton Co. (buyer). Assume both of the companies use the perpetual inventory system.July 3

Abbott Co. sold merchandise on account to Dalton Co., $7,500, terms FOB shipping point, net/eom. The cost of the goods sold was $4,400.5

Dalton Co. paid $275 freight charges on purchase from Abbott Co.9

Abbott Co. issued Dalton Co. a credit memo for merchandise returned, $2,250.The cost of the merchandise returned was $1,325.11

Abbott Co. received payment from Dalton Co. for purchase of July 3.

Definitions:

Treasury Stock

Shares that were once part of the outstanding shares of a company but were later reacquired by the company itself.

Deferred Tax Asset

A tax reduction or benefit that arises due to temporary differences between the book value and tax value of assets and liabilities, which can be used to offset future tax liabilities.

Income Taxes Payable

The amount of income tax a company owes to the government but has not yet paid, usually accumulated over a financial period.

Income Tax Expense

The amount of money a company owes in taxes based on its taxable income.

Q34: The following revenue and expense account balances

Q68: Alpha Company has current assets of $74,524,

Q92: What is the year-end inventory balance using

Q125: Safeguarding inventory and proper reporting of the

Q128: An adjusting entry would adjust revenue so

Q130: If the effect of the debit portion

Q135: Accruals are needed when an unrecorded expense

Q138: Bloom's Company pays biweekly salaries of $40,000

Q167: Assuming that the company uses the perpetual

Q199: Using the table provided, calculate total sales,