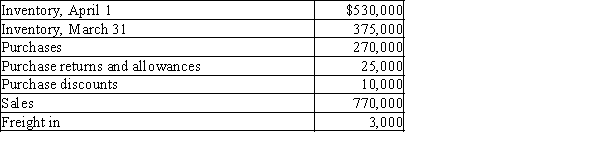

The following data were extracted from the accounting records of Dana Designs for the year ended March 31.  Prepare the gross profit and cost of goods sold section of the income statement for the year ended March 31, using the periodic method.

Prepare the gross profit and cost of goods sold section of the income statement for the year ended March 31, using the periodic method.

Definitions:

Basis

The amount of investment in a property for tax purposes, used to calculate gain or loss on the sale or other disposition of the property.

Condemnation Proceeds

Financial compensation received when property is taken by a government authority through eminent domain.

Recognized Gain

The amount of profit that is realized from the sale of assets that must be reported for tax purposes.

Adjusted Basis

The original cost of a property adjusted for factors such as depreciation or improvements, used to calculate capital gains or losses for tax purposes.

Q13: The current ratio for the past three

Q29: Stergell Company had sales of $1,500,000 and

Q44: Buyers and sellers do not normally record

Q48: Which of the following accounts ordinarily appears

Q98: The end-of-period spreadsheet is a tool that

Q141: The balance sheet accounts are referred to

Q167: It is not necessary to post the

Q196: The inventory system employing accounting records that

Q211: On the basis of the following data,

Q218: The adjusting entry to account for normal