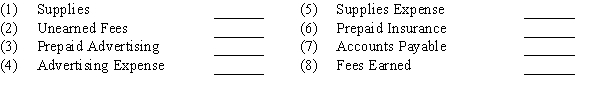

Indicate whether each of the following would be reported in the financial statements as a (a) current asset, (b) current liability, (c) revenue, or (d) expense:

Definitions:

Gain-Sharing Plans

Incentive plans that reward employees for contributing to the company's efficiency and productivity improvements by sharing the resulting financial gains.

Profit-Sharing Plans

An incentive plan in which employees receive a portion of the company's profits, typically allocated based on the company's earnings over a set period.

Deferred Plan

A type of savings plan that allows employees to defer a portion of their income to a later date, typically used for retirement savings.

Current Distribution Plan

The existing strategy for allocating resources, goods, or services among various recipients or locations.

Q17: The arrangements between buyer and seller as

Q51: The adjusting entry to adjust supplies was

Q100: The following entry was recorded in the

Q127: In which order are the accounts listed

Q141: The balance sheet accounts are referred to

Q161: Which of the following is an example

Q163: Working capital is the ratio of the

Q207: Using the perpetual inventory system, journalize the

Q226: Which of the following stockholders' equity accounts

Q244: Alt Tile Company uses a perpetual inventory