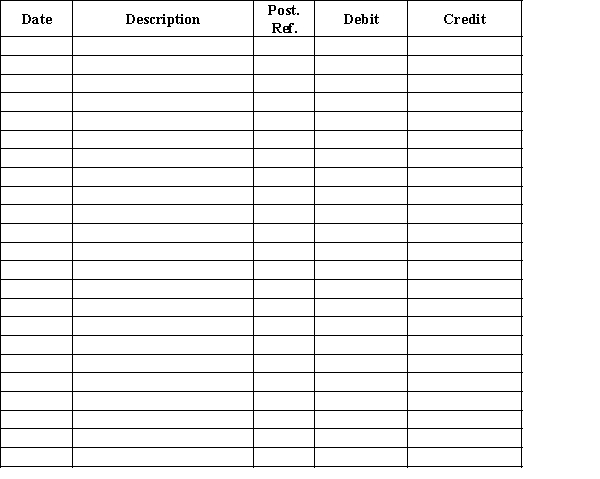

Journalize the following selected transactions for January. Explanations may be omitted.Jan.1

Received cash from the sale of common stock, $14,000.2

Received cash for providing accounting services, $9,500.3

Billed customers on account for providing services, $4,200.4

Paid advertising expense, $700.5

Received cash from customers on account, $2,500.6

Paid dividends, $1,010.7

Received telephone bill, $900.8

Paid telephone bill, $900.

Definitions:

Profit-sharing Plans

Compensation schemes where employees receive additional benefits based on the company's profits, designed to align employees' interests with the financial success of the organization.

Shares

Ownership units in a company that represent a portion of the equity and entitle the holder to a share of the corporation's profits, often through dividends.

Bonus Pay Plan

A compensation strategy where employees receive additional pay based on performance, often aimed at incentivizing higher productivity.

Incentive Compensation

Incentive compensation is a form of payment designed to motivate and reward employees' performance, often tied to achieving specific goals or benchmarks.

Q8: Which of the following accounts would likely

Q15: The accounts in the ledger of Monroe

Q42: Held-to-maturity securities<br>A)are reported at fair value on

Q47: In order to maintain a record of

Q64: When shares of stock held as an

Q96: The cash-to-cash operating cycle is the number

Q108: Indicate whether each of the following would

Q121: The monetary value earned for selling goods

Q130: A dressmaking company<br>A)Service business<br>B)Manufacturing business<br>C)Retail business

Q196: The net assets of a company are