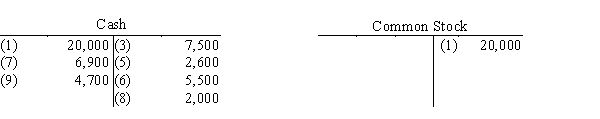

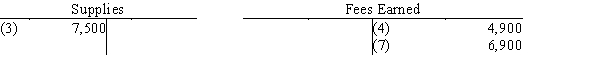

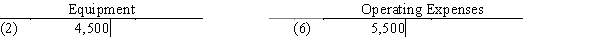

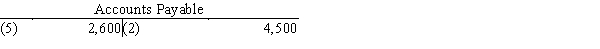

All nine transactions for Dalton Survey Company for September, the first month of operations, are recorded in the following T accounts:

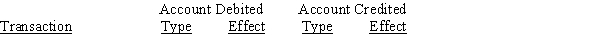

Indicate the following for each debit and each credit:

Indicate the following for each debit and each credit:

(a)The type of account affected (asset, liability, equity, dividends, revenue, or expense).(b)The effect on the account, using "+" for increase and "−" for decrease.

Present your answers in the following form:

Definitions:

Quantitative Variable

A variable that can be measured numerically and expresses quantities.

Frequency Distribution

A summary of how often different values occur within a data set, often represented as a table or graph.

Scale Levels

Categories that describe the nature of data measurement, including nominal, ordinal, interval, and ratio scales.

Quantitative Distinctions

Differences that can be measured or described using numbers.

Q14: Which of the following entries records the

Q41: Present entries to record the following selected

Q129: Copyrights

Q131: All stockholders' equity accounts record increases to

Q136: Refer to the data for Sunshine Farm

Q155: What is the major difference between the

Q164: The business entity assumption means that<br>A)the owner

Q206: Interest Revenue

Q217: (a) Explain the differences between accrued revenues

Q220: Accounts payable are accounts that you expect