Daniels Company made the following selected transactions during May:

1.Received cash from sale of stock, $55,000

2.Paid creditors on account, $7,000

3.Billed customers for services on account, $2,565

4.Received cash from customers on account, $8,450

5.Paid dividends to stockholders, $2,500

6.Received the utility bill, $160, to be paid next month

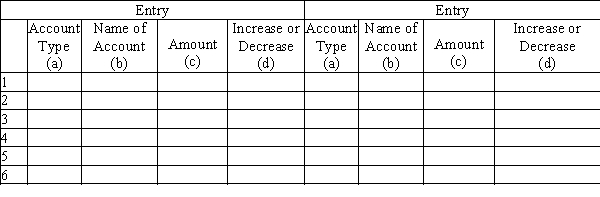

Indicate the effect of each transaction on the accounting equation by:

(a)Account type - (A)assets, (L)liabilities, (SE)stockholders' equity, (R)revenue, and (E)expense

b)Name of account

c)The amount by of the transaction

d)The direction of change (increase or decrease) in the account affected

Note: Each transaction has two entries.

Definitions:

Carryover

Unused tax credits or deductions that can be applied to future tax years to reduce tax liability.

Short-term Loss

A loss realized on the sale or exchange of an asset held for one year or less.

Long-term Loss

The loss realized from the sale of an asset held for more than one year, which can offset long-term gains for tax purposes.

Capital Gain

The profit made from the sale of a capital asset, like real estate or stocks, that exceeds the purchase price.

Q17: Refer to the Paint Company data. The

Q19: Refer to the data for Sunshine Farm

Q109: Held-to-maturity securities<br>A)are reported at fair value<br>B)include stocks

Q150: The current ratio<br>A) is generally smaller than

Q152: When an account payable is paid with

Q153: Expenses result from selling services or products

Q159: Presented below is the operating activities section

Q179: What situations could cause a decrease in

Q192: How does paying a liability in cash

Q221: Common Stock