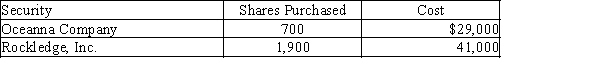

During the first year of operations, Makala Company purchased two trading investments as follows:  Assume that as of December 31, the Oceanna Company stock had a market value of $49 per share and Rockledge, Inc. stock had a market value of $20 per share. Makala had 10,000 shares of no-par stock outstanding that was issued for $150,000. For the year ending December 31, Makala had net income of $105,000. No dividends were paid.

Assume that as of December 31, the Oceanna Company stock had a market value of $49 per share and Rockledge, Inc. stock had a market value of $20 per share. Makala had 10,000 shares of no-par stock outstanding that was issued for $150,000. For the year ending December 31, Makala had net income of $105,000. No dividends were paid.

(a)Prepare the current assets section of the balance sheet presentation for the trading securities as of December 31.(b)Explain how the gain or loss would be reported on the income statement.

Definitions:

Q8: Because net income is on an after-tax

Q16: Upon review of Young's Garden Center statement

Q27: Which of the following statements is not

Q29: All line items in common-size comparative income

Q44: On October 30, JumpStart pays $3,330 in

Q70: The statement of cash flows summarizes the

Q104: Parks Company reported an increase of $370,000

Q112: when using this, dividends are treated as

Q112: The two groups of users that are

Q175: Computer Corporation is starting its computer programming