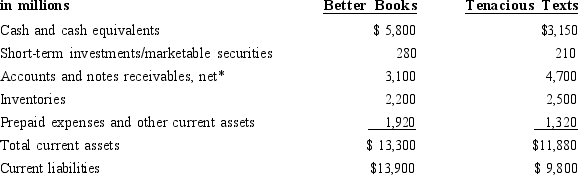

The following information was summarized from the balance sheets of the Better Books and Tenacious Texts at December 31, 2016:

REQUIRED:

REQUIRED:

1. Using the information provided, compute the following for each company at the end of 2016:

a. Current ratio

b. Quick ratio

2. Better Books reported cash flow from operations of $7,500 million during 2016. Tenacious Texts reported cash flow from operations of $7,000 million. Current liabilities reported by Better Books and Tenacious Texts at December 31, 2015, were $13,200 million and $7,700 million, respectively. Compute the cash flow from operations to current liabilities ratio for each company for 2016.

3. Comment briefly on the liquidity of each of these two companies. Which appears to be more liquid?

4. What other ratios would help you more fully assess the liquidity of these companies?

Definitions:

Surpluses

Situations in which the quantity of a good or service supplied exceeds the quantity demanded at a given price.

Migration

The movement of individuals or groups from one location to another, often for reasons such as employment, education, or economic opportunities.

Price Supports

Government interventions to maintain the price of a good or service at a certain level to encourage production and protect producers.

Producers' Income

The earnings or revenue received by the producers or firms from the sale of goods or services before the deduction of any expenses.

Q10: The following items appear on the balance

Q33: If a company reports a net loss

Q35: On January 1, 2015, Bogart Acres Company

Q47: Use the information below for Shorter Inc.

Q64: Given the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7934/.jpg" alt="Given

Q90: Times interest earned ratio<br>A)increase<br>B)decrease

Q111: From the following list of items taken

Q115: If the proceeds from the sale of

Q130: With respect to the statement of cash

Q145: Discuss the characteristics of a limited liability