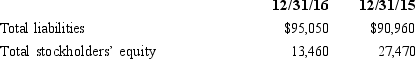

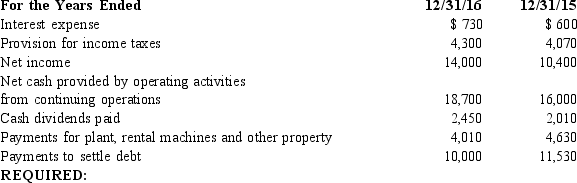

The following information was obtained from the comparative financial statements included in Arco Inc.'s 2016

annual report. All amounts are in millions of dollars.

1. Using the information provided, compute the following for 2016 and 2015:

a. Debt-to-equity ratio at each year-end

b. Times interest earned ratio

c. Debt service coverage ratio

d. Cash flow from operations to capital expenditures ratio

2. Comment briefly on the company's solvency.

Definitions:

Callable Bond

A type of bond that can be redeemed by the issuer before its maturity date, typically at a premium price.

Convertible Bond

A type of bond that can be converted into a predetermined amount of the company's equity at certain times during its life, usually at the discretion of the bondholder.

Yankee Bond

A bond issued in the United States by foreign banks and corporations, denominated in U.S. dollars.

DAX

The stock market index that represents 40 of the largest and most liquid German companies trading on the Frankfurt Stock Exchange.

Q55: Which of the following statements is false

Q70: Investment in Bonds is reported on the

Q75: The objective of the indirect method is

Q75: The denominator of a return ratio will

Q106: Which of the following transactions is a

Q139: In place of _, a worksheet is

Q205: Assume the following independent situations:<br>1. Company A

Q233: Turtle Island Music Store reported net income

Q242: The first statement prepared<br>A)Income statement<br>B)Balance sheet<br>C)Statement of

Q244: Which of the following statements with regard