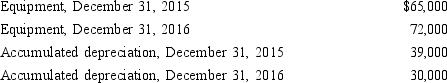

Use the information below for Alpha Inc. for 2015 and 2016 to answer the following question.  During 2016, Alpha Inc. sold equipment with a cost of $30,000 and accumulated depreciation of $25,000. A gain of

During 2016, Alpha Inc. sold equipment with a cost of $30,000 and accumulated depreciation of $25,000. A gain of

$3,000 was recognized on the sale of the equipment This was the only equipment sale during the year.

What amount would be reported as the cash proceeds from the sale of equipment?

Definitions:

Lochner V. New York

A landmark U.S. Supreme Court case in 1905 that struck down a New York law setting limits on working hours, marking a significant moment in the relationship between labor laws and governmental regulation.

Fourteenth Amendment

An amendment to the U.S. Constitution, adopted in 1868, granting citizenship to all persons born or naturalized in the United States and guaranteeing all citizens equal protection of the laws.

Government Interference

Actions by government bodies that affect the operations of businesses, organizations, or individual freedoms, often viewed negatively by those who advocate for minimal governmental involvement.

Charles Beard

An influential American historian who proposed that the Constitution was designed to protect the economic interests of its framers.

Q5: Parker Company owns 83% of the outstanding

Q31: Under IFRS, an item such as a

Q47: Use the information below for Shorter Inc.

Q56: A fiscal year that ends when business

Q82: On October 1, Marcus Corporation purchased $20,000

Q90: Port, Inc. paid a cash dividend on

Q126: Because the cash received from the sale

Q135: Discuss the appropriate financial treatment when an

Q185: A company may prepare a statement of

Q215: You want to know whether selling and