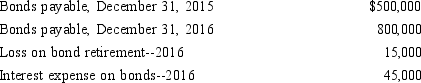

Use the information below for Fargo Corp. for 2015 and 2016 to answer the following question.  At the end of 2016, Fargo issued bonds at par value for $800,000 cash. The proceeds from these bonds were used to retire the $500,000 bond issue outstanding at the end of 2015 before their maturity date. All interest expense was paid in cash during 2016.

At the end of 2016, Fargo issued bonds at par value for $800,000 cash. The proceeds from these bonds were used to retire the $500,000 bond issue outstanding at the end of 2015 before their maturity date. All interest expense was paid in cash during 2016.

How much did Fargo pay to retire the $500,000 bond issue during 2016?

Definitions:

Bullwhip Measure

A quantification of the bullwhip effect, which illustrates how variations in demand can be amplified as one moves up the supply chain.

Standard Deviation

A statistical measure of the dispersion or variability in a data set, indicating how much individual data points deviate from the mean or average.

Cash for Clunkers

A government program intended to stimulate the economy and encourage the purchase of new vehicles by offering financial incentives for trading in older, less-efficient cars.

Bullwhip Effect

A phenomenon in supply chains where small variations in demand at the retail level cause progressively larger fluctuations in demand at the wholesale, distributor, and manufacturer levels.

Q24: Refer to the financial information for St.

Q26: Which category of cash flows - operating,

Q33: If a company reports a net loss

Q54: Springfield Company's comparative balance sheets included inventory

Q74: On June 1, $50,000 of treasury bonds

Q99: When bonds are issued by a company,

Q120: The return on sales ratio is a

Q139: Carlton, Inc. presented the following information in

Q150: Weather Corp. issued 10-year, 8%, $100,000 bonds

Q170: Treetop Company paid off a $100,000 two-year