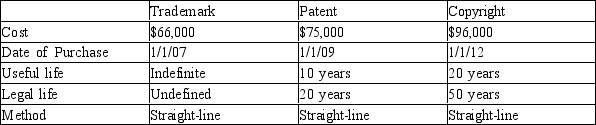

For each of the following intangible assets, indicate the amount of amortization expense that should be recorded for the year 2014 and the amount of accumulated amortization on the balance sheet as of December 31, 2014.

Definitions:

Solvency

The ability of an entity to meet its long-term financial obligations and continue its operations into the foreseeable future.

ASPE

Accounting Standards for Private Enterprises; a set of accounting practices and standards for private companies in Canada.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board (IASB) that serve as a global framework for preparing financial statements.

Comparability

An accounting principle that ensures financial statements can be consistently compared across different periods and entities.

Q9: The company financed the equipment purchase with

Q17: When constructing assets, capitalized interest is based

Q29: Refer to the information about Norwood, Inc.

Q62: Depreciation is<br>A) an effort to achieve proper

Q89: What impact does materiality have on the

Q109: Dayton Ridge Co. purchased new trucks at

Q130: Allowance method<br>A)A receivable arising from the sale

Q164: If collection of accounts receivable is assured,

Q165: Marsh Corporation borrowed $90,000 by issuing a

Q222: Depreciation expense<br>A)Operating<br>B)Investing<br>C)Financing<br>D)Not separately reported on a statement