Hu Corporation

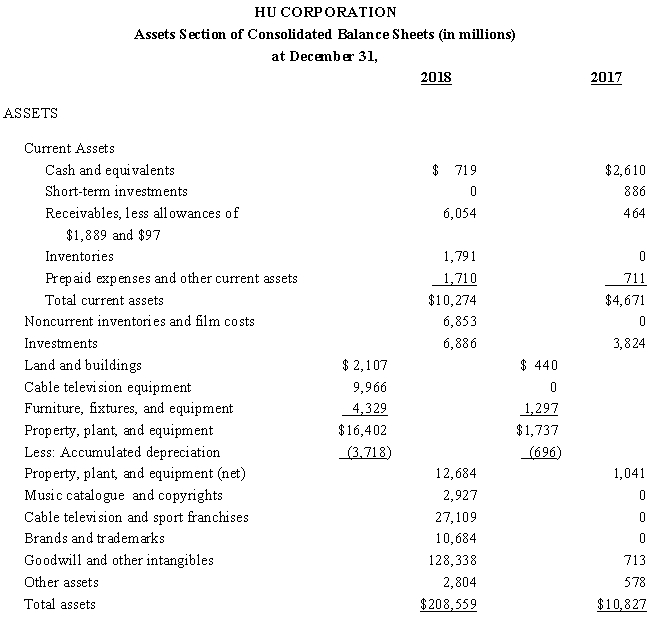

Use the following Assets section of Hu Corporation's balance sheets for the years ended December 31,2018 and 2017 to answer the questions that follow.

Hu Corporation recorded depreciation expense of $344 million for 2017.

Hu Corporation recorded depreciation expense of $344 million for 2017.

-Refer to the information for Hu Corporation.

Required

(1)Explain the impact on net income and cash flows of Hu using straight-line depreciation for financial reporting and accelerated depreciation methods for income tax purposes.

(2)In the notes to the financial statements,Hu indicates that it uses different depreciation methods for different types of plant and equipment assets.Explain why Hu might follow this policy.

Definitions:

Ontario Ministry

Refers to the various departments or branches of the provincial government in Ontario, Canada, responsible for specific areas of public policy, administration, and services.

Order of Canada

A national honor granted in Canada to individuals for their outstanding achievements, dedication to the community, and service to the nation.

Means of Production

The resources—including tools, machinery, and raw materials—required to produce goods and services, often discussed in the context of ownership in theories of economics and socialism.

Industrial Technology

Relates to the application of engineering and manufacturing technology to make production faster, simpler, and more efficient.

Q9: The company financed the equipment purchase with

Q53: An is a form the accounting department

Q90: Newco Publishing Company purchased equipment at the

Q100: When one company purchases less than 50%

Q126: Estimated liability for product warranties to be

Q128: How much depreciation expense did the company

Q132: Check written on the company's account and

Q139: Which of the following costs related to

Q158: On July 1, 2015, Clayton Shop borrowed

Q222: Depreciation expense<br>A)Operating<br>B)Investing<br>C)Financing<br>D)Not separately reported on a statement