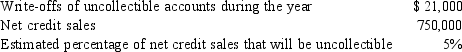

In its first year of business, Mariman Company has net income of $290,000, exclusive of any adjustment for bad debts expense. The president of the company has asked you to calculate net income under each of two alternatives of accounting for bad debts: the direct write-off method and the allowance method. The president would like to use the method that will result in the higher net income. So far, no adjustments have been made to write off uncollectible accounts or to estimate bad debts. The relevant data are as follows:

REQUIRED:

REQUIRED:

1. Compute net income under each of the two alternatives.

2. Does Mariman have a choice as to which method to use? If so, should it base its choice on which method will

result in the higher net income? Ignore income taxes. Explain.

Definitions:

Temperature Range

The difference between the maximum and minimum temperatures in a given area over a period, important for determining climate conditions.

Oceanic Province

That part of the open ocean that overlies an ocean bottom deeper than 200 m. Compare with neritic province.

Greatest Volume

Refers to the largest amount or capacity of something, often used in various contexts like measurements, storage, or descriptions of space.

Ocean Water

The saltwater that makes up the oceans covering most of the Earth's surface, distinct from fresh water.

Q57: The gross profit ratio is computed by

Q76: Control account<br>A)A receivable arising from the sale

Q104: Acquisition cost is also referred to as

Q148: Can a company use the direct write-off

Q149: Discounting<br>A)A liability resulting from the signing of

Q161: Long-term assets are $5,000, current liabilities are

Q163: The following accounts are listed in a

Q166: A good system of internal controls requires

Q169: Sales returns and allowances is a contra

Q197: Wyoming Real Estate purchased a building for