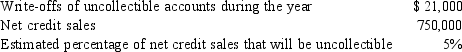

In its first year of business, Mariman Company has net income of $290,000, exclusive of any adjustment for bad debts expense. The president of the company has asked you to calculate net income under each of two alternatives of accounting for bad debts: the direct write-off method and the allowance method. The president would like to use the method that will result in the higher net income. So far, no adjustments have been made to write off uncollectible accounts or to estimate bad debts. The relevant data are as follows:

REQUIRED:

REQUIRED:

1. Compute net income under each of the two alternatives.

2. Does Mariman have a choice as to which method to use? If so, should it base its choice on which method will

result in the higher net income? Ignore income taxes. Explain.

Definitions:

Systematic Method

An orderly, planned approach to solving a problem, typically involving steps that are carefully followed.

Lewin's Change Model

A framework for understanding organizational change, containing three steps: unfreezing, changing, and refreezing.

Unfreezing

The initial stage in Lewin's change model that involves reducing forces maintaining the current state, enabling the acceptance of new behaviors or thoughts.

Logical Incrementalism

A strategy of making decisions through small, logical steps instead of large, radical changes.

Q21: The solution to this problem requires time

Q23: Which method of inventory costing is not

Q29: Which internal control procedure is followed when

Q39: Explain by what processes the costs of

Q80: If a customer returns merchandise which has

Q81: Research and development costs are<br>A) treated as

Q156: The accountant for Rogan Corp. was preparing

Q169: A purchase order is not the basis

Q180: The payee of a note recognizes on

Q197: Which one of the following procedures is