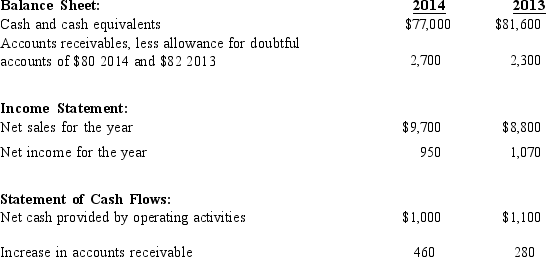

The comparative financial statements for the years ended December 31, 2014 and 2013 for Sophia Company reported the following information.

Answer these questions concerning Sophia Company's receivables:

Answer these questions concerning Sophia Company's receivables:

A What is the gross amount of accounts receivable for Sophia at December 31, 2014? Why is this amount different than the amount of receivables shown in the 2014 column of the balance sheet?

B What is the net realizable value of accounts receivable for Sophia at December 31, 2014? What does this amount represent?

Definitions:

Direct Materials

Raw materials that are directly attributable to the production of goods, forming an integral part of the finished product.

Conversion Costs

The costs incurred to convert raw materials into finished goods, comprising both direct labor costs and manufacturing overhead.

Conversion Costs

Expenses for labor and overhead that transform raw materials into finished goods.

FIFO Method

An inventory valuation method where the first items purchased or produced are the first ones to be sold or used, standing for "First In, First Out."

Q80: Each of the following documents is used

Q111: A contingent liability is recorded if it

Q121: Which internal control procedure is followed when

Q122: Maturity value<br>A)A liability resulting from the signing

Q126: Rafter.com received a 10%, 90-day promissory note

Q136: A statement of cash flows reports property,

Q137: Refer to the data for Music Corporation.

Q149: Discounting<br>A)A liability resulting from the signing of

Q150: Refer to the data for Learning Tree,

Q225: Wang Fitness Co. purchased a patent at