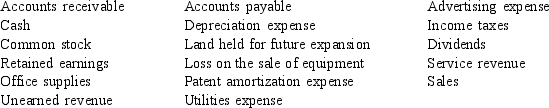

Potential stockholders and lenders are interested in a company's financial statements. Several financial statement items appear below. Answer the questions that follow.

A Which two items would stockholders be most interested in that can either be computed from the above data or are included in the items listed above? Explain why the two you selected are important to stockholders.

A Which two items would stockholders be most interested in that can either be computed from the above data or are included in the items listed above? Explain why the two you selected are important to stockholders.

B In which one item would lenders be most interested? Explain why this item is important.

Definitions:

Government Expenditure

The total amount of spending by a government on goods, services, and public works.

Output

The quantity of goods or services produced in a given period by a firm, industry, or country.

Multiplier Size

A measure of the impact of fiscal and monetary policies on the national income, showing how initial spending leads to increased total spending.

Fiscal Policy

Government policies regarding taxation and spending that are used to influence economic conditions, including stimulating or restraining economic growth.

Q5: The nurse works in a rehabilitation facility.Which

Q11: When preparing to administer medication through a

Q15: All of the following statements are true

Q19: The nurse answers a client's emergency call

Q20: The nurse is caring for a client

Q22: While providing care for an older adult

Q53: Land<br>A)Current Assets<br>B)Property. Plant, and Equipment<br>C)Current Liabilities<br>D)Long-term Liabilities<br>E)Stockholders'

Q125: Which of the following accounts are normally

Q139: Which of the following best describes a

Q277: Which one of the following is not