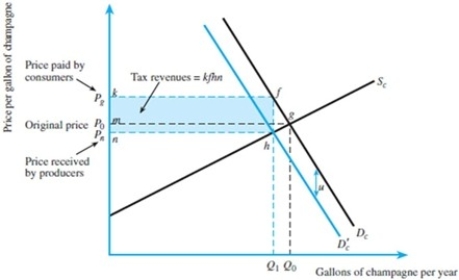

Refer to the figure below. Suppose the original before-tax demand curve for champagne is P = 100 - 2Qd. Suppose further that supply is P = 5 + 3Qs. Now suppose a $5 unit tax is imposed on consumers.

(A)What is the before-tax equilibrium price and quantity?

(A)What is the before-tax equilibrium price and quantity?

(B)What is the after-tax equilibrium price and quantity?

(C)How much tax revenue is raised?

Definitions:

Residential Hot Water Heater

A device used in homes to heat water for domestic purposes such as bathing and cooking.

Selling Price

The amount a product or service is sold for, which could include profit margins beyond the cost of goods.

Mountain Bikes

Bicycles designed specifically for off-road cycling, featuring durable frames, wide tires with deep tread for added stability and grip on uneven terrain.

Manufacturer's Markup Percent

The percentage added to the cost of goods by manufacturers to determine the selling price.

Q14: The percentage of children living in low

Q18: had the highest post-secondary expenditures per student

Q22: When the federal government gives a grant

Q24: The Canada Pension Plan is fully funded.<br>A)True<br>B)False<br>C)Uncertain

Q30: A person's education _.<br>A)generates positive externalities<br>B)does not

Q36: A subsidy on consumers will cause<br>A)a movement

Q39: In reconciling a bank statement, the bank

Q40: If a single person is authorised to

Q54: Accounts receivable has a balance of $5

Q114: On 1 September 2013, Adirondac Marine Supplies