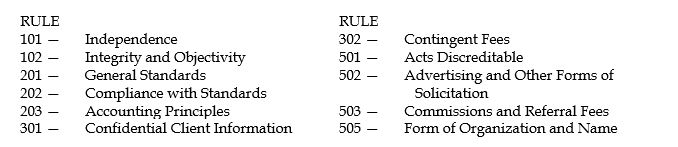

For each of the following actions by a member CPA, indicate (1) the rule of conduct that is applicable and (2) whether the actions does (yes) or does not (no) violate the rule. You may identify the rule by number on your answer sheet. Your selections can be made from the following list:  1.Discriminates in employment.

1.Discriminates in employment.

2.Makes recommendations but not the decisions in an MCS engagement for a nonpublic client.

3.Permits a non-CPA to be the chairman of the board of a CPA firm organized as a professional corporation.

4.Fails to make inquiries in a review of interim financial information.

5.Accepts a commission from a vendor, with the permission of the audit client, for

recommending the vendor's product.

6.Indicates that he will perform the audit of a city's united fund charity for a nominal fee.

7.Transfers working papers, with the client's permission, to the client's new auditors.

8.Subordinates his judgment in favor of the client in tax practice when there is little support for the client's position.

9.Indicates the number of partners, CPAs and offices in his or her firm in an advertisement.

10.States that the fee in a tax case will be based on the amount of tax saving realized.

11.Fails to conform to a recently issued SAS, which has an immaterial effect on the financial statements.

12.A personnel manager in the office doing the audit of a client has a financial interest in the client.

13.Fails to adequately plan and supervise an MCS engagement.

14.Agrees to serve as an honorary director of a charitable foundation.

15.Knowingly misrepresents facts in an engagement.

Definitions:

Q9: Role-playing a client helps you to understand

Q11: Professional relationships differ from friendships in all

Q14: The ASB has members that represent small

Q17: Which of the following requires managements of

Q19: For which of the following accounts is

Q22: When personal and professional values conflict, _

Q23: The primary communication of audit findings is

Q29: The title of a certain working paper

Q29: The booklet titled Governmental Auditing Standards is

Q53: Auditing is not possible in the absence