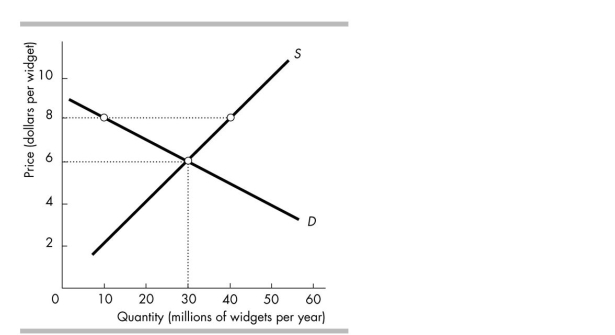

-In the figure above, if a tax of $2 per widget is imposed on sellers, then the after- tax amount per widget received by the seller will be

Definitions:

Departments

Divisions within an organization, each responsible for specific functions or tasks.

Departmental Predetermined Overhead Rates

Rates calculated in advance for each department, used to assign overhead costs based on estimated activity levels.

Machine-Hours

A measure of the total time that machines are operating, often used as a basis for allocating manufacturing overhead costs.

Markup

The amount added to the cost price of goods to cover overhead and profit, resulting in the selling price.

Q13: The cost of producing an additional unit

Q32: A sales tax is divided so that

Q33: A tariff is a<br>A) subsidy on an

Q36: A country opens up to trade and

Q38: The table above shows the marginal costs

Q52: The table above gives the number of

Q55: The figure above shows supply curves for

Q97: In the table above, what is the

Q124: The concept of elasticity of supply measures

Q143: A tariff imposed by Australia on Japanese