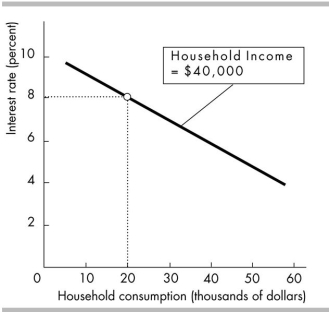

-The relationship in the above figure indicates that

Definitions:

Beta

A gauge of the variability in a stock's price relative to the whole market.

Risk-Free Rate

The anticipated rate of return on an investment devoid of risk, commonly represented by the interest rates of government bonds.

Market Risk Premium

The extra return expected by investors for holding a risky market portfolio instead of risk-free assets, reflecting the additional risk.

Overall Operations

Refers to the comprehensive activities and processes undertaken by a business to produce and sell its products or services.

Q1: In the above figure, the curve has

Q8: Using the letters provided below, symbolize this

Q26: Measured wealth is a less accurate indicator

Q28: If a monopolist lowers its price and

Q29: A Lorenz curve graphs the<br>A) cumulative percentage

Q54: Which two goods will most likely have

Q126: Preferences depend on<br>A) relative prices but not

Q128: If a natural monopoly has an average

Q133: If Sam has $80.00 each week to

Q135: Juanita has taken six courses at Valley