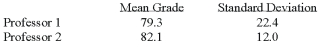

Two accounting professors decided to compare the variation of their grading procedures. To accomplish this they each graded the same 10 exams with the following results:  At the 1% level of significance, what is the decision?

At the 1% level of significance, what is the decision?

Definitions:

Overhead

The total cost of running a business that cannot be directly attributed to the production of goods or services, similar to factory overhead but can apply to non-manufacturing costs.

Overhead Allocation Base

A measure or activity, such as direct labor hours or machine hours, used to assign overhead costs to products or services.

Direct Labor Hours

The total hours worked directly on a product or service by employees in the production process.

Overhead Rate

A measure used to allocate overhead costs to produced goods, calculated by dividing total overheads by an allocation base, such as labor hours.

Q1: Of 150 adults who tried a new

Q11: One of the major U.S. tire makers

Q27: The z-value associated with a 96% level

Q40: What is a Type II error?<br>A) Accepting

Q51: i. An index is a convenient way

Q53: i. Chi-square goodness-of-fit test is the appropriate

Q70: For which independent variable does a unit

Q98: i. The fifth and final step in

Q178: Given: null hypothesis is that the population

Q204: i. An alternate hypothesis is a statement