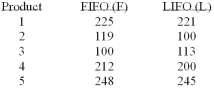

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?  What is the null hypothesis?

What is the null hypothesis?

Definitions:

Net Operating Income

An accounting term that represents the revenue minus the cost of goods sold and operating expenses, excluding taxes and interest.

Degree Of Operating Leverage

A measure, at a given level of sales, of how a percentage change in sales will affect profits. The degree of operating leverage is computed by dividing contribution margin by net operating income.

Variable Expenses

Costs that vary in direct proportion to changes in an activity level or volume, such as sales commissions.

Sales Increase

The rise in the volume or amount of sales or revenue a company achieves in a specific period compared to a previous period.

Q6: At a recent automobile show, a sample

Q12: Based on the Nielsen ratings, the local

Q20: The mean gross annual incomes of certified

Q25: Six people have declared their intentions to

Q31: A survey of the opinions of property

Q72: i. For the population means, the alternate

Q100: How does the t distribution differ from

Q129: If the alternate hypothesis states that μ

Q156: What is the critical z-value for a

Q179: A restaurant that bills its house account