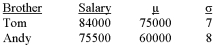

Two competitive brothers, who work in two different industries, were comparing their salaries. Because there is a difference of 4 years in their respective work experience, they decided to compare, not their actual salaries, but to compare their salaries against their company averages to see who is doing better. The following gives the brothers' salaries, companies' mean, and standard deviation for each company.  Which brother earns a higher salary compared to the rest of their colleagues?

Which brother earns a higher salary compared to the rest of their colleagues?

Definitions:

NAV

Net Asset Value (NAV) represents the per-share market value of all the securities held by a mutual fund, ETF, or similar investment vehicle, calculated by subtracting the fund's liabilities from its assets and dividing by the number of shares outstanding.

Income Distributions

Payments made to investors from the income generated by the assets within a fund or investment, such as dividends or interest payments.

Capital Gain Distributions

Payments made to investors of profits from the sale of securities within a portfolio, often associated with mutual funds.

Rate of Return

The gain or loss on an investment over a specified time period, expressed as a percentage of the investment's initial cost.

Q5: The Sugar Producers Association wants to estimate

Q8: Each salesperson in a large department store

Q42: A sample of assistant professors on the

Q50: Dawson's Repair Service orders parts from an

Q53: Given: null hypothesis is that the population

Q60: Listed below is the average earnings ratio

Q72: Listed below is the box plot of

Q98: i. The fifth and final step in

Q126: The dean of a business school claims

Q173: A survey of passengers on domestic flights