Test the indicated claim about the means of two populations. Assume that the two samples are independent simple random samples selected from normally distributed populations. Do not assume that the population standard deviations are equal.

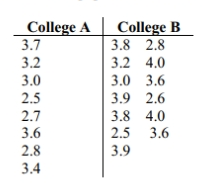

Use a 0.10 significance level to test the claim that the mean GPA of students at college A is different from the mean GPA of students at college B.

(Note:

Include your null and alternative hypotheses, the test statistic, p -value or critical value(s), conclusion about the null hypothesis, and conclusion about the claim in your answer.

Definitions:

Diluted Earnings Per Share

A metric that calculates the quality of earnings per share (EPS) if all convertible securities were converted into common stock, indicating the potential dilution that could occur.

Diluted EPS

Earnings per share calculated under the assumption that all convertible securities and options have been converted into additional shares, potentially lowering the EPS.

Stock Options

Contracts that give the holder the right, but not the obligation, to buy or sell a stock at a specific price before a certain date.

High-Growth Companies

Entities that experience significantly higher rates of growth compared to the average growth rate of their industry.

Q2: Explain what an efficiency rating is. You

Q4: List the assumptions for testing hypotheses that

Q11: Which of the following cumulative frequency

Q12: A quadratic regression model is fit

Q18: Use the given degree of confidence

Q18: If test A has an efficiency rating

Q20: Use the given information to find

Q43: Formulate the indicated conclusion in nontechnical terms.

Q46: Using the data below and a

Q177: A weather forecaster predicts that the temperature