Determine whether the linear transformation T is one-to-one and whether it maps as specified.

-

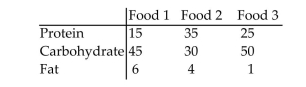

Betty would like to prepare a meal using some combination of these three foods. She would like the meal to contain of protein, of carbohydrate, and of fat. How many units of each food should she use so that the meal will contain the desired amounts of protein, carbohydrate, and fat? Round to 3 decimal places.

Definitions:

Specific Goals

Clear, defined, and measurable objectives that one aims to achieve within a certain timeframe.

Specified Period

A fixed or clearly defined duration of time.

Dietary Assessment Method

Techniques or tools used to evaluate the nutritional value of a person's diet, often through the collection and analysis of dietary intake data.

Usual Intake Form

A dietary assessment tool used to record an individual's typical food and beverage consumption over a specific period.

Q1: In <span class="ql-formula" data-value="R ^

Q3: <span class="ql-formula" data-value="\mathbf { y } =

Q17: <span class="ql-formula" data-value="\begin{array} { l } 7

Q17: <span class="ql-formula" data-value="\left[ \begin{array} { r r

Q18: The frequency table below shows the

Q33: Emily Corp.owned shares in Carr Ltd.On December

Q41: <span class="ql-formula" data-value="B = \left[ \begin{array} {

Q56: For what values of h are

Q263: If, during an accounting period, an expense

Q329: When expenses are presented by function in