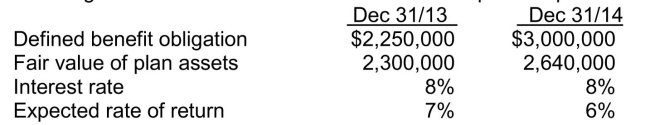

Pension plan calculations The following information relates to the defined benefit pension plan for Strawberry Dale Ltd.:  In 2014, the corporation contributed $390,000 to the plan, and the trustee paid $210,000 in benefits to retirees.Strawberry Dale uses the immediate recognition approach under IFRS. Instructions For the year ended December 31, 2014:

In 2014, the corporation contributed $390,000 to the plan, and the trustee paid $210,000 in benefits to retirees.Strawberry Dale uses the immediate recognition approach under IFRS. Instructions For the year ended December 31, 2014:

a.Calculate the interest on the obligation.

b.Calculate the actual return on plan assets.

c.Calculate the unexpected gain or loss (if any).

Definitions:

Q3: <span class="ql-formula" data-value="A"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mi>A</mi></mrow><annotation encoding="application/x-tex">A</annotation></semantics></math></span><span

Q82: <span class="ql-formula" data-value="A = \left[ \begin{array} {

Q90: Note issued for cash and other rights

Q91: Bundled sales Loon Inc., a software company

Q136: Generally, revenue from sales should be recognized

Q238: The residual interest in a corporation belongs

Q302: The actions a company takes to add

Q330: Which of the following does NOT describe

Q494: Preparing a statement of cash flows under

Q499: Stakeholders who help in the efficient allocation