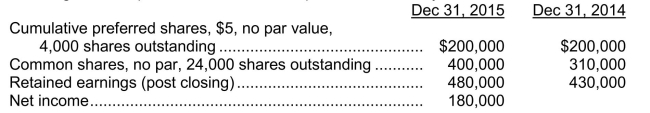

Use the following information for questions. The following data are provided for Croatia Corp.'s last two fiscal years:  Shareholders' Equity 15- 27 Additional information: On May 1, 2015, 6,000 common shares were issued.Although dividends had been declared regularly up to December 31, 2014, preferred dividends were NOT declared during 2015.The market price of the common shares was $100 at December 31, 2015.

Shareholders' Equity 15- 27 Additional information: On May 1, 2015, 6,000 common shares were issued.Although dividends had been declared regularly up to December 31, 2014, preferred dividends were NOT declared during 2015.The market price of the common shares was $100 at December 31, 2015.

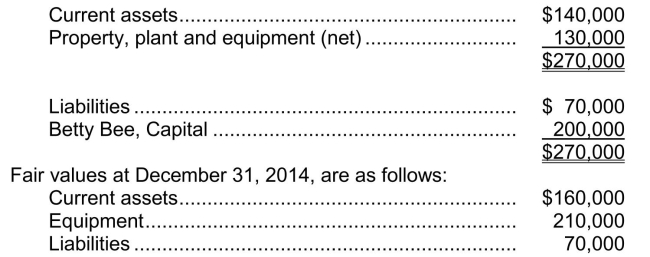

-The December 31, 2014 condensed balance sheet of Bee Services, a proprietorship, follows:  On January 1, 2015, Bee Services was incorporated as Bee-Line Ltd., with 10,000 no par value common shares issued.How much should be credited to Common Shares?

On January 1, 2015, Bee Services was incorporated as Bee-Line Ltd., with 10,000 no par value common shares issued.How much should be credited to Common Shares?

Definitions:

Partnership

A business entity created when two or more persons collaborate to operate a business and share its profits, losses, and responsibilities.

Transferable Interest

An ownership interest in an entity that can be transferred or sold to another party, subject to any restrictions in the entity's governing documents.

Distributions

Payments made by a business to its stakeholders from its profit or assets.

Accounting Books

Official records that track financial transactions and the financial position of an entity.

Q10: Which of the following is generally NOT

Q11: <span class="ql-formula" data-value="\left[ \begin{array} { r r

Q13: Diaz should record interest expense for 2017

Q42: <span class="ql-formula" data-value="A = \left[ \begin{array} {

Q45: <span class="ql-formula" data-value="y \mathrm { k }

Q77: The direct write off method of accounting

Q128: Interim reporting There is ongoing discussion as

Q129: Fudge Ltd.receives a four-year, $100,000 zero-interest bearing

Q156: On December 1, 2014, Corby Ltd.borrowed $270,000

Q355: Which of the following does NOT support