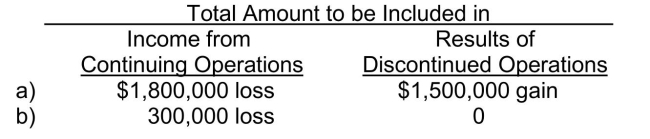

During 2014, Cantaloupe Corp disposed of Raspberry Division, a major segment of its business.Cantaloupe realized a gain of $1,500,000, net of taxes, on the sale of Raspberry's assets.During 2014, Raspberry's operating losses, net of taxes, were $1,800,000.How should these facts be reported in Cantaloupe's income statement for 2014?

Definitions:

Land

The surface of the earth not covered by water, considered as property and factor of production, it also includes natural resources like minerals, forests, and crops.

Townshend Acts

A series of British acts passed beginning in 1767 and 1768 relating to the British colonies in North America, imposing duties on the importation of certain goods, which led to widespread protest.

Imported Goods

Products brought into one country from another for sale or trade.

Raising Revenue

The process of generating income for a government or organization, typically through taxation, fees, or the sale of goods and services.

Q33: Find the echelon form of the

Q55: Let <span class="ql-formula" data-value="\mathbf {

Q62: Accounting procedures for bond redemptions Describe the

Q74: <span class="ql-formula" data-value="\left[ \begin{array} { r r

Q129: Fudge Ltd.receives a four-year, $100,000 zero-interest bearing

Q140: Accumulating rights to benefits (for employees)<br>A)are rarely

Q156: Revenue recognition Below are several independent situations

Q236: Gross profit method On January 1, Jasper

Q274: Goods in transit which are shipped f.o.b.destination

Q319: On February 1, 2013, Chocolate Corp.factored receivables