Use the following information for questions For Pear Limited, events and transactions during 2015 included the following.The tax rate for all items is 30%. 1) Depreciation for 2014 was found to be understated by $30,000. 2) A strike by the employees of a supplier resulted in a loss of $20,000. 3) The inventory at December 31, 2013 was overstated by $40,000. 4) A flood destroyed a building that had a book value of $400,000.Floods are very uncommon in that area.

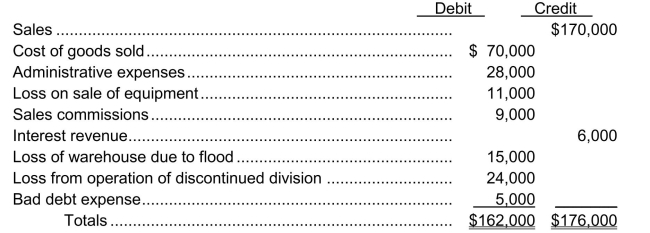

-Sesame Corp.'s adjusted trial balance at December 31, 2014 included the following:  Sesame uses the perpetual system, and their income tax rate is 30%.On Sesame's multiple- step income statement for 2014, income from discontinued operations is

Sesame uses the perpetual system, and their income tax rate is 30%.On Sesame's multiple- step income statement for 2014, income from discontinued operations is

Definitions:

Sales Revenue

The income received by a company from its sales of goods or services before any expenses are deducted.

Working Capital

The measure of a company's short-term liquidity, determined by subtracting current liabilities from current assets.

Short-Run Liquidity

The ability of a company to meet its short-term financial obligations and operate in the near future without facing financial distress.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or within the normal operating cycle of the business.

Q12: Suppose an economy consists of three

Q18: Let <span class="ql-formula" data-value="A =

Q25: The accrual basis of accounting<br>A)must be used

Q28: <span class="ql-formula" data-value="\begin{aligned}5 x _ { 2

Q73: When a contract becomes unprofitable to an

Q133: On January 1, 2014, Susan Hong lent

Q204: Amortization of discount under the straight-line and

Q221: Which of the following does NOT correctly

Q233: Warsaw Ltd.has 100,000 no par value common

Q246: Which statement is NOT true about the