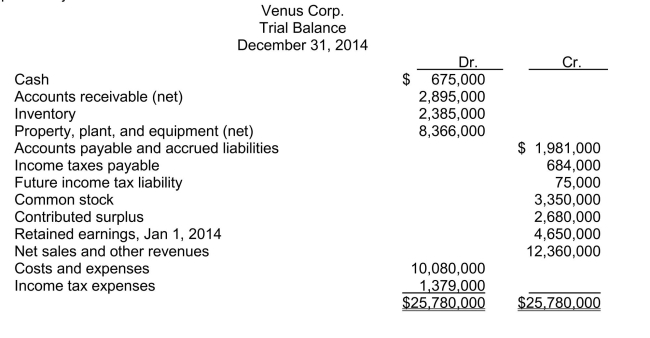

Use the following information for questions Venus Corp.'s trial balance at December 31, 2014 is properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014: - Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2016. - The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability. - During the year, estimated tax payments of $465,000 were charged to income tax expense. The current and future tax rate on all types of income is 35 percent.

Other financial data for the year ended December 31, 2014: - Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2016. - The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability. - During the year, estimated tax payments of $465,000 were charged to income tax expense. The current and future tax rate on all types of income is 35 percent.

-In Venus's December 31, 2014 statement of financial position, the current assets total is

Definitions:

Advertising Budget

The amount of money allocated for promoting a product, service, or brand during a specific period.

Break-even

A position where overall costs and revenues balance out, culminating in zero net profit or loss.

Monthly Unit Sales

The total number of units of product sold in a month, often used to monitor sales trends and performance.

Break-even Point

The point at which total costs and total revenue are equal, resulting in no net profit or loss for the business.

Q31: Assuming that Lock uses the perpetual inventory

Q102: Under the earnings approach, if a company

Q131: Asset exchange Arabia Inc.traded its fleet of

Q172: When all outstanding preferred shares are purchased

Q205: Wilma received merchandise on consignment from Bubbles.As

Q266: White Resources determines that it has not

Q322: Perpetual FIFO A record of transactions for

Q390: The essential characteristic(s)of accounting is (are)<br>A)communication of

Q446: An enterprise's ability to pay its debts

Q478: The Sarbanes-Oxley Act (SOX)was NOT enacted to<br>A)help