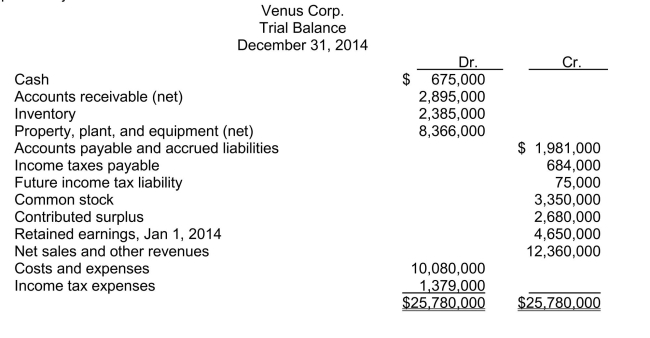

Use the following information for questions Venus Corp.'s trial balance at December 31, 2014 is properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014: - Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2016. - The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability. - During the year, estimated tax payments of $465,000 were charged to income tax expense. The current and future tax rate on all types of income is 35 percent.

Other financial data for the year ended December 31, 2014: - Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2016. - The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability. - During the year, estimated tax payments of $465,000 were charged to income tax expense. The current and future tax rate on all types of income is 35 percent.

-In Venus's December 31, 2014 statement of financial position, the current liabilities total is

Definitions:

Tennis Club

An organization or venue that offers facilities and membership for people interested in playing tennis.

Shareholder Voting Agreement

A contract among shareholders detailing how they will vote their shares on certain matters.

Irrevocable Proxy

A proxy or voting right given by a shareholder that cannot be revoked for a certain period, usually used in corporate settings.

Long-Term Proxies

Documents that authorize another individual to vote on behalf of a shareholder for an extended period.

Q17: A feature common to both stock splits

Q26: The price earnings ratio for 2015 is<br>A)12.22.<br>B)13.76.<br>C)14.99.<br>D)15.55.

Q57: Taxable loss carryforward with valuation allowance (ASPE)

Q66: A copper wire (d = 1.5

Q66: Under the relative fair value method, how

Q173: For last month, Perma Corp.'s cost of

Q321: The book (or electronic database)containing the accounts

Q414: Financial accounting can be broadly defined as

Q428: Recording purchases at net amounts Mexico Inc.records

Q433: Capitalization of interest In February 2015, Quorum