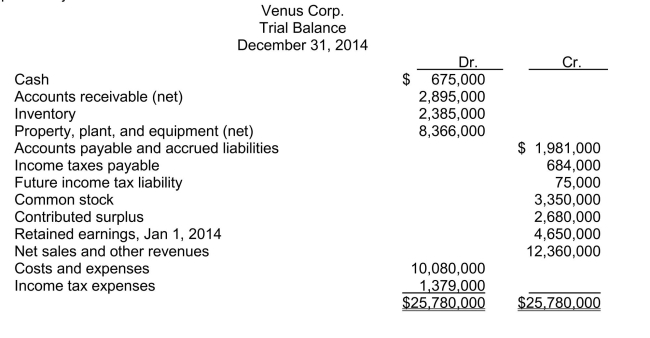

Use the following information for questions Venus Corp.'s trial balance at December 31, 2014 is properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014: - Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2016. - The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability. - During the year, estimated tax payments of $465,000 were charged to income tax expense. The current and future tax rate on all types of income is 35 percent.

Other financial data for the year ended December 31, 2014: - Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2016. - The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability. - During the year, estimated tax payments of $465,000 were charged to income tax expense. The current and future tax rate on all types of income is 35 percent.

-In Venus's December 31, 2014 statement of financial position, the final retained earnings balance is

Definitions:

Nearsighted

A visual condition, also known as myopia, where close objects are seen clearly, but distant objects appear blurred.

Elongated

Extended or lengthened in shape or duration.

Cataract

A medical condition in which the lens of the eye becomes progressively opaque, resulting in blurred vision.

Hue

A basic property of color defined by the wavelength of light, denoting the color itself, such as red, blue, or green.

Q10: Which of the following is generally NOT

Q54: If a long-term note is issued with

Q56: An L-shaped beam is loaded as

Q160: Which of the following should NOT be

Q182: Early extinguishment of debt On August 1,

Q340: At the end of its accounting year,

Q375: For purposes of discontinued operations, the key

Q379: The IASB and FASB are currently working

Q410: During the year, Brownie Inc, who uses

Q468: The completed contract method for accounting for