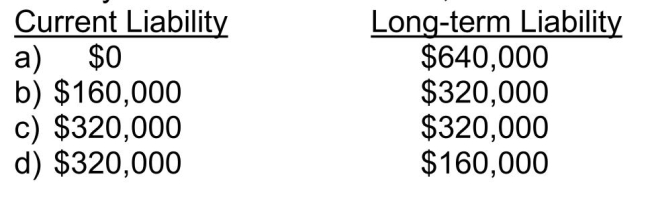

On January 1, 2014, Mars Inc.leased a building to Vulcan Corp.for a ten-year term at an annual rental of $160,000.At inception of the lease, Mars received $640,000, which covered the first two years rent of $320,000 and a security deposit of $320,000.This deposit will not be returned to Vulcan upon expiration of the lease, but will be applied to payment of rent for the last two years of the lease.What portion of the $640,000 should be shown as a current and long- term liability in Mars's December 31, 2014 statement of financial position?

Definitions:

Profitable

A financial state in which income exceeds costs and expenses, resulting in a net gain.

Constraint

A limitation or restriction on a process, system, or activity.

Invested Assets

Assets that are purchased or acquired for the purpose of generating income or profit.

Production Cost

The total expense incurred in manufacturing a product, including labor, materials, and overhead costs.

Q4: Principles-based GAAP is sometimes criticized for being<br>A)too

Q10: All else being equal, which of the

Q45: When a note payable is issued for

Q95: Reversing entries are usually used for<br>A)accrued revenues

Q156: On December 1, 2014, Corby Ltd.borrowed $270,000

Q165: The matching principle is best demonstrated by<br>A)not

Q249: On July 1, 2014, Salmon Corp.issued $600,000,

Q250: A corporation's net income or loss is

Q320: Under a consignment sales arrangement, revenue is

Q381: For adjusting entries relating to accrued revenues,<br>A)a