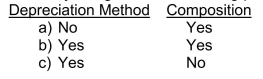

Which of the following facts concerning depreciable assets should be included in the summary of significant accounting policies?  Financial Position and Cash Flows 5 - 19

Financial Position and Cash Flows 5 - 19

Definitions:

Absorption Costing

A costing technique that encompasses both direct and indirect expenses associated with the production in the product's cost.

Contribution Margin

The amount by which sales revenue exceeds variable costs of a product, indicating how much revenue contributes toward covering fixed costs and generating profit.

Production Efforts

The exertion of labor and use of resources by a company towards the manufacturing of goods.

EBITDA

Earnings Before Interest, Taxes, Depreciation, and Amortization, a measure of a company's operating performance.

Q24: A prismatic shaft (diameter <span

Q25: The moment reaction at A in

Q30: Accounting for GST includes<br>A)crediting GST Payable to

Q67: Under ASPE, an asset retirement obligation should

Q174: A troubled debt restructuring will generally result

Q215: A constructive obligation arises when<br>A)the entity is

Q232: The fair value of a property dividend

Q236: Gross profit method On January 1, Jasper

Q239: A possible result of the reacquisition and

Q349: Preparation of consolidated financial statements when a