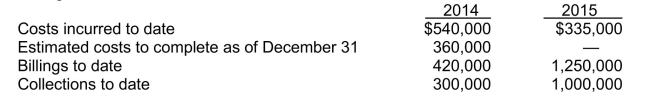

Use the following information for questions. Tuba Ltd.began work in 2014 on a contract for $1,250,000.Other data are:  Revenue Recognition 6 - 19

Revenue Recognition 6 - 19

-Beaver Builders Ltd.is using the completed-contract method for a $2,000,000 contract that will take two years to complete.Data at December 31, 2014, the end of the first year, are:  The gross profit or loss that should be recognized for 2014 is

The gross profit or loss that should be recognized for 2014 is

Definitions:

Capital Leases

Leases that are recognized by the lessee as an asset and liability on the balance sheet, based on the assumption that it involves the transfer of ownership over the lease term.

Balance Sheet

A financial statement that reports a company's assets, liabilities, and shareholders' equity at a specific point in time, showing the company's financial position.

Operating Lease

A lease agreement for the use of an asset without ownership transfer.

IFRS

International Financial Reporting Standards, which are a set of accounting standards developed by the International Accounting Standards Board (IASB) that serve as a global framework for financial reporting.

Q86: Which of the following actions would NOT

Q96: Solve the double inequality <span

Q163: Cash dividends declared on the no par

Q170: To record a "basket purchase" or to

Q209: Which of the following is a current

Q230: Restrictions included in restricted covenants do NOT

Q238: A post-closing trial balance<br>A)includes temporary accounts only.<br>B)includes

Q258: At December 31, 2013 and 2014, Gee

Q272: You want to improve the qualitative characteristics

Q345: How much of the expenses listed above