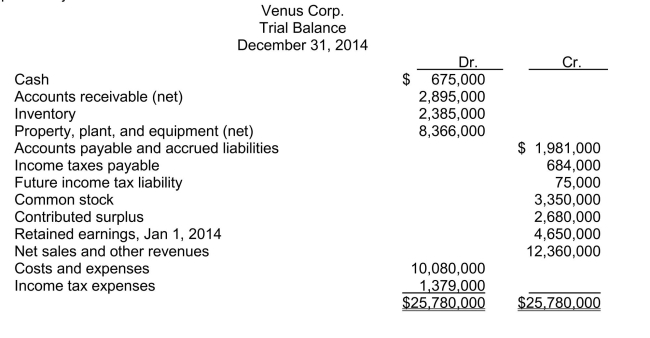

Use the following information for questions Venus Corp.'s trial balance at December 31, 2014 is properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014: - Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2016. - The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability. - During the year, estimated tax payments of $465,000 were charged to income tax expense. The current and future tax rate on all types of income is 35 percent.

Other financial data for the year ended December 31, 2014: - Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2016. - The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability. - During the year, estimated tax payments of $465,000 were charged to income tax expense. The current and future tax rate on all types of income is 35 percent.

-In Venus's December 31, 2014 statement of financial position, the current assets total is

Definitions:

Intimacy

A close, familiar, and affectionate personal relationship with another person that involves a deep level of emotional connection.

Social Connection

Describes the relationships people have with others and the resulting sense of belonging and support obtained through these interactions.

Homeostasis

A state of balance in the body's internal environment, despite external changes.

Pores To Constrict

The process by which the openings of the skin's sweat glands become smaller, often as a response to cold temperatures or certain skincare products.

Q21: Rome Corp.was organized on January 1, 2014,

Q52: The graph of <span class="ql-formula"

Q66: Under the relative fair value method, how

Q118: Presented below is information available for Radon

Q151: The liability of shareholders is<br>A)similar to the

Q190: Share subscriptions On April 28, 2014, Sweden

Q236: Gross profit method On January 1, Jasper

Q404: The problem of information asymmetry can be

Q431: Intraperiod tax allocation<br>A)allocates tax balances between fiscal

Q480: Which of the following best describes the