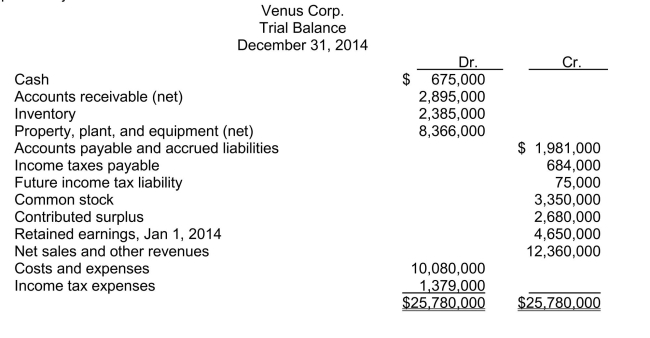

Use the following information for questions Venus Corp.'s trial balance at December 31, 2014 is properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014: - Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2016. - The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability. - During the year, estimated tax payments of $465,000 were charged to income tax expense. The current and future tax rate on all types of income is 35 percent.

Other financial data for the year ended December 31, 2014: - Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2016. - The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability. - During the year, estimated tax payments of $465,000 were charged to income tax expense. The current and future tax rate on all types of income is 35 percent.

-In Venus's December 31, 2014 statement of financial position, the final retained earnings balance is

Definitions:

Color Blindness

A visual impairment where an individual has difficulty distinguishing between certain colors, typically reds, greens, and sometimes blues.

Polygenic Inheritance

A pattern in which many genes all influence a single trait.

Phenylketonuria

A genetic disorder characterized by the body's inability to metabolize the amino acid phenylalanine, leading to its accumulation and potential brain damage.

Schizophrenia

A severe mental disorder characterized by disruptions in thought processes, perceptions, emotional responsiveness, and social interactions.

Q7: T: <span class="ql-formula" data-value="R ^

Q22: Structure 1 with member BC of

Q35: The likelihood of loss because of the

Q115: According to the CBCA, when a company

Q168: Premiums Fido Corp.includes one coupon in each

Q195: Sale and subsequent buyback of bonds On

Q224: Which of the following is(are)NOT recommended to

Q251: Which of the following transactions would NOT

Q417: By how much should the account payable

Q487: Calculate depreciation and CCA A machine costing