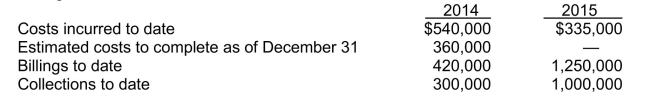

Use the following information for questions. Tuba Ltd.began work in 2014 on a contract for $1,250,000.Other data are:  Revenue Recognition 6 - 19

Revenue Recognition 6 - 19

-Beaver Builders Ltd.is using the completed-contract method for a $2,000,000 contract that will take two years to complete.Data at December 31, 2014, the end of the first year, are:  The gross profit or loss that should be recognized for 2014 is

The gross profit or loss that should be recognized for 2014 is

Definitions:

Depreciation

The accounting process of allocating the cost of tangible assets over their useful lives, reflecting wear and tear, or obsolescence.

Capital Gain/Loss

The profit or loss made from selling an asset for more or less than its purchase price.

Depreciates

The process by which an asset loses value over time, often due to wear and tear, age, or obsolescence, impacting its useful life.

Straight Line

A method of calculating depreciation of an asset which assumes equal annual depreciation over the asset's useful life.

Q91: A steel bracket ABCD <span

Q119: Segmented reporting (IFRS requirements) A central issue

Q196: The net method of recording accounts receivable

Q206: Calculation of net income from the change

Q291: Which of the following is/are major factors

Q313: Pate Ltd.has the following data related to

Q405: Which of the following situations does NOT

Q411: In a rules-based approach (such as U.S.GAAP),

Q428: Recording purchases at net amounts Mexico Inc.records

Q462: When substantially all risks and rewards of