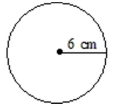

Find the circumference of the circle. Use 3.14 for

Definitions:

AGI

Adjusted Gross Income, calculated as gross income minus adjustments, is a key figure in determining taxable income and eligibility for various tax deductions and credits.

Premium Tax Credit

A repayable tax credit intended to assist qualified individuals and families with low or moderate incomes in purchasing health insurance via the Health Insurance Marketplace.

Qualified Plan

A retirement plan that meets the requirements of the Internal Revenue Code, allowing for tax-deferred contributions and earnings until withdrawal.

Household Income

The combined gross income of all members of a household, used to determine eligibility for certain credits and deductions.

Q6: Find the expected age at death of

Q10: Find the probability that a person will

Q11: Find the missing probability of dying in

Q12: Which table of points is correct for

Q13: Solve the system using the substitution method.

Q13: Write the rate as a unit rate.

Q29: Following is a set of observed

Q31: Which of the following sample types should

Q66: The sales tax on a bookcase is

Q72: Write the phrase as an algebraic expression.