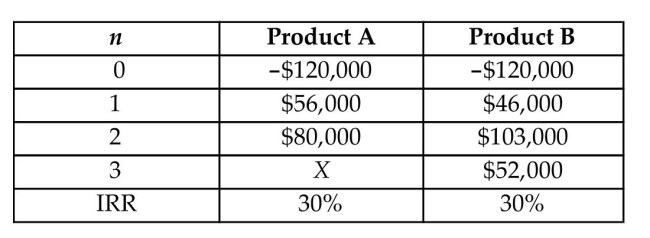

A manufacturing firm is considering two types of gear coupling products. Due to insufficient production

capacity as well as anticipated market competition, the firm wants to manufacture and market only one type of

product at this time. The required investments as well as the projected cash flows over a three-year market life

for each product are as follows:  The firm's MARR is known to be 15% for this type of project.

The firm's MARR is known to be 15% for this type of project.

(a) Determine the required cash flow in year 3 (X) for product A, to have a 30% return on investment.

(b) With the value of X determined in (a), which product should be undertaken based on the principle of IRR?

Definitions:

Economic Resources

The land, labor, capital, and entrepreneurial ability that are used to produce goods and services; the factors of production.

Marginal Costs

The extra expense generated from the production of an additional unit of a product or service.

R&D Costs

Expenses related to the research and development activities of a company, often aimed at discovering new products or improving existing products.

Easy-to-Copy Products

Products that can be replicated or imitated with ease due to their simple designs, lack of patent protection, or the availability of manufacturing techniques.

Q2: The U.S. Department of Interior is planning

Q4: If exactly two independent variables are to

Q10: A series of equal semi-annual payments of

Q12: Identify the critical value T .

Q24: State a conclusion about the null hypothesis.

Q33: Find the probability of eight fire ants

Q73: The distance, <span class="ql-formula" data-value="s

Q73: For a one-to-one function, we can find

Q145: An accidental spill of 80 grams

Q231: <span class="ql-formula" data-value="\ln 2 + \ln x