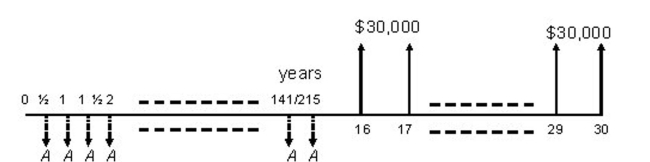

Henry Jones is planning to retire in 15 years. He wishes to deposit an equal amount (A) every 6 months until he

retires so that, beginning one year following his retirement, he will receive annual payments of $30,000 for the

next 15 years. Determine the value of A which he should deposit every 6 months if the interest rate is 8%,

compounded semi-annually

Definitions:

Signaling Effect

The signaling effect is a theory in finance suggesting that the actions of a company, such as dividend announcements or share buybacks, send signals to the market about its future prospects.

Dividend Policy

A company's approach to distributing profits to its shareholders, determining how much to pay out in dividends and how often.

Investor Confidence

The degree of faith that investors have in the stability and profitability of the financial markets, influencing their willingness to invest.

Clientele Effect

A theory suggesting that the stock price movements are influenced by the preferences of a company's current shareholder base.

Q1: Which of the following statements is most

Q3: Determine the minimum VO2MAX score for elite

Q9: <span class="ql-formula" data-value="\log _ { y }

Q18: 99%

Q26: <span class="ql-formula" data-value="\log _ { 10 }

Q28: For the site effect, state a conclusion

Q30: Find the expected age at death of

Q32: Find the standard deviation and the variance

Q78: <span class="ql-formula" data-value="e ^ { 4 x

Q251: <span class="ql-formula" data-value="\log _ { 3 }