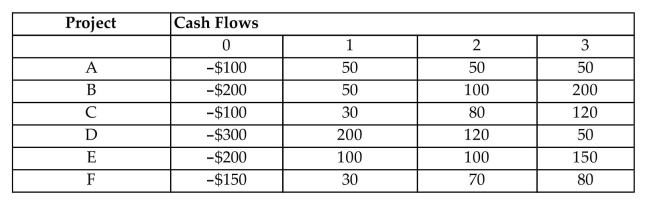

Consider the following investment projects and their interdependencies:  Projects A and B are mutually exclusive.

Projects A and B are mutually exclusive.

Projects C and F are independent projects

Project D is contingent on Project C.

Project E is contingent on project B.

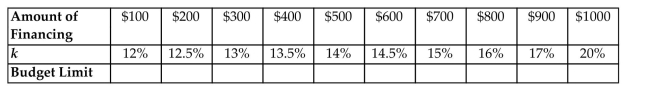

The following indicates the cost of capital as a function of budget:  The firm has lending opportunities at 9%.

The firm has lending opportunities at 9%.

Formulate the entire list of mutually exclusive decision alternatives.

What is the optimal capital budget? Which projects would be funded under the optimal capital budget?

If the firm has a budget limit placed at $600, which projects would be funded? What is the appropriate MARR?

Definitions:

Accounts Receivable

Money owed to a business by its clients or customers for goods or services delivered or used but not yet paid for.

Q4: Using probability values, determine if it is

Q6: If one of the surviving succulent plants

Q15: State a conclusion about the null hypothesis

Q28: For the site effect, state a conclusion

Q29: Find the odds ratio of the odds

Q81: <span class="ql-formula" data-value="x ^ { 2 }

Q99: <span class="ql-formula" data-value="\log _ { \mathrm {

Q114: f(x)=x+7 ; g(x)=5x - 2

Q115: <span class="ql-formula" data-value="x ^ { 4 }

Q235: <span class="ql-formula" data-value="\log _ { b }