Five years ago, a conveyor system was installed in a manufacturing plant at a cost of $35,000. It was estimated

that the system, which is still in operating condition, would have a useful life of eight years, with a salvage

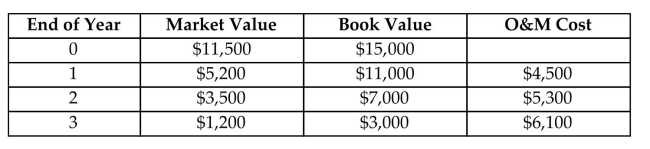

value of $3,000. If the firm continues to operate the system, the system's estimated market values and operating

costs for the next three years are as follows:  A new system can be installed for $43,500. This system would have an estimated economic life of 10 years, with

A new system can be installed for $43,500. This system would have an estimated economic life of 10 years, with

a salvage value of $3,500. The operating costs for the new system are expected to be $1,500 per year throughout

its service life. The firm's MARR is 18%. The system belongs to the seven-year MACRS property class. The firm

's marginal tax rate is 35%.

(a) Should the existing system be replaced?

(b) If the decision in (a) is to replace the existing system, when should replacement occur?

Definitions:

Merchandise Inventory

Goods and products that a retailer, wholesaler, or distributor holds for the purpose of resale to customers.

Finished Goods Inventory

The stock of completed products that are ready to be sold but have not yet been sold.

Factory Overhead Cost

All indirect costs associated with manufacturing, such as maintenance and cleaning of equipment, which cannot be directly traced back to the production of specific goods.

Manufacturing Process

The sequence of operations or techniques used to transform raw materials or components into finished goods.

Q1: Referring to the probability distribution for dental

Q4: Identify the five number summary for the

Q7: Use a .05 significance level and the

Q8: Find the rate of return for the

Q8: Which of the following statements is most

Q33: If a cumulative frequency distribution were constructed

Q46: <span class="ql-formula" data-value="x ( 5 x +

Q164: Business people are concerned with cost

Q228: <span class="ql-formula" data-value="x ^ { 3 }

Q269: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7570/.jpg" alt=" A)