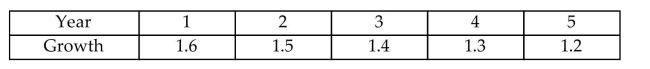

You are considering an investment in a tree farm. Trees grow each year by the following factors:  The price of lumber follows a binomial lattice with

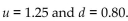

The price of lumber follows a binomial lattice with  0. The interest rate (risk-free) is constant

0. The interest rate (risk-free) is constant

at 6%. It costs $2 million each year, payable at the beginning of the year, to lease the forest land. The initial value

of the trees is $5 million (assuming they were harvested immediately). You can cut the trees at the end of any

year and then not pay rent after that. With rent of $2 million per year, find the best cutting policy and the value

of the investment opportunity.

Definitions:

Cognitive Restructuring

A psychotherapeutic process of learning to identify and dispute irrational or maladaptive thoughts known as cognitive distortions, such as "all-or-nothing" thinking.

Pessimistic Attributional Styles

A tendency to habitually explain negative events with causes that are stable, global, and internal.

Internal Validity

The extent to which a research study provides evidence that a causal relationship exists between the variables tested, without influence from external factors.

External Validity

How much the outcomes of a research can be extrapolated to different contexts and different people.

Q5: Consider the following project cash flows. <img

Q6: Margin of error: four percentage points; confidence

Q8: You are planning to lease an automobile

Q12: Find the standard deviation from the binomial

Q16: Choose the choice of statistics that best

Q47: Use the square root property to

Q55: <span class="ql-formula" data-value="2 y - \frac {

Q168: Use the square root property to

Q188: <span class="ql-formula" data-value="\mathrm { f } =

Q190: <span class="ql-formula" data-value="f ( x ) =