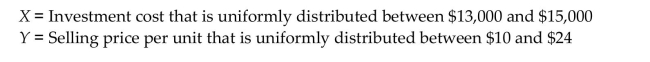

A new project will require $X in investment today and is expected to provide a net cash outflow of $1000(Y) for

the next two years where:  (a) Determine and simplify the NPV equation assuming the risk-free rate is 6%.

(a) Determine and simplify the NPV equation assuming the risk-free rate is 6%.

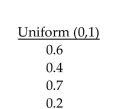

(b) Given the following sequence of uniform random deviates, calculate the first iteration for this NPV

equation. Note that the selling price, once determined at period 1 will be the same value will be assumed in

period 2. In statistical term, selling prices are perfectly positively correlated each other. Also assume that X and

Y are statistically independent.

Definitions:

Pointers

Variables in programming that store the memory address of another variable, allowing direct access and manipulation of its value.

Pointers

Variables that store the memory address of another variable.

Relational Operators

Symbols that are used to compare two values and determine the relationship between them.

Q1: In 2010, a biotechnology firm, DNA Map

Q5: Use a .05 significance level and the

Q9: Determine the value of the <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2682/.jpg"

Q11: If three members are randomly selected for

Q25: Identify the critical value(s).

Q27: Identify the P-value and level of significance.

Q39: Identify the null hypothesis and alternative hypothesis.

Q123: <span class="ql-formula" data-value="2 x ^ { 2

Q215: <span class="ql-formula" data-value="- 2 x ^ {

Q220: <span class="ql-formula" data-value="\log _ { 5 }