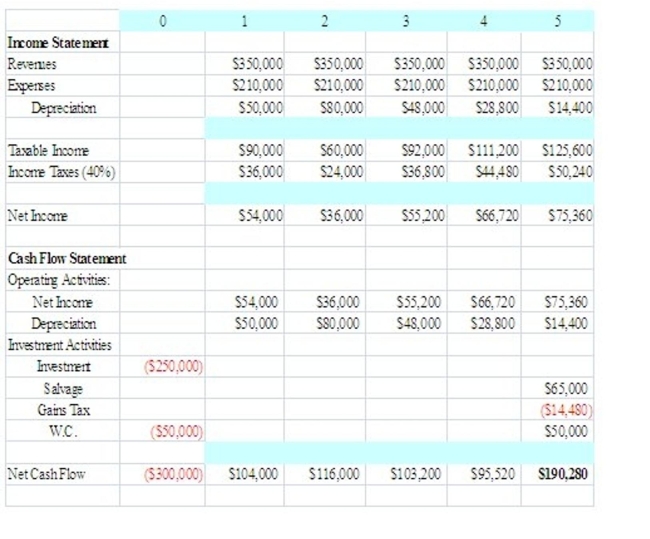

Consider the following financial data for an investment project:

Definitions:

Straight Bond Value

The present value of a bond's future interest payments plus the value of its principal, assuming it does not come with any special features like options.

Conversion Value

The monetary value of a convertible security if it were converted into shares of the underlying company at the current market price.

Convertible Bond

A bond which offers the option to be exchanged for a specific number of the issuing company's stock at certain periods throughout its duration, typically at the option of the person holding the bond.

Equity

represents the value of the shares issued by a company, denoting the ownership interest held by shareholders in the corporation.

Q1: If one of the individuals is randomly

Q8: Find the probability that a randomly selected

Q8: Find the sample standard deviation of the

Q13: State a conclusion about the null hypothesis

Q37: Determine whether a probability distribution is given

Q120: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7570/.jpg" alt=" A) one-to-one B)

Q126: Suppose a city with population of 170,000

Q181: <span class="ql-formula" data-value="\frac { 1 } {

Q222: <span class="ql-formula" data-value="x ^ { 2 }

Q271: <span class="ql-formula" data-value="\log _ { 3 }