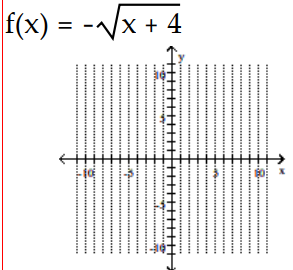

Graph the function.

-

Definitions:

Progressive Tax

A tax system in which the tax rate increases as the taxable amount increases, with higher earners paying a higher percentage of their income in taxes.

Social Security Tax

Social Security tax is a payroll tax collected to fund the Social Security program, which provides retirement, disability, and survivorship benefits to qualifying individuals.

Federal Personal Income Tax

A tax levied by the U.S. federal government based on an individual's income, including wages, salaries, and investments.

Taxable Income

The portion of an individual's or entity's income used to determine how much tax is owed to the government.

Q4: {(-4,-6),(8,-7),(-2,2),(9,7),(11,-8)} <br>A) Domain: {-4,8,-2,9,11} ;

Q6: If the company sells 3000 bottles of

Q26: Sketch the graph of the equation.

Q47: <span class="ql-formula" data-value="\left\{ \begin{aligned}y & = 4

Q49: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" A) Function B)

Q57: <span class="ql-formula" data-value="x ^ { 2 }

Q69: A rectangular holding pen for sheep

Q199: Vertical; through (-8, -9)<br>A) y = -8<br>B)

Q202: <span class="ql-formula" data-value="- 2 y + 3

Q216: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7570/.jpg" alt=" A)